Stamp duty All service agreements one tier Ad valoremrate of 01 Multi-tier service agreement. Stamp duty on a loan agreement is calculated at a fixed rate of 05 percent which is applied to the whole amount of the loan.

The Validity Of Unstamped Agreements In Malaysia Fareez Shah And Partners

The penalty for late sealing varies depending on the period of delay.

. RM10000 or 20 of the amount of the deficient duty whichever sum be the greater in any other case if the instrument is stamped beyond six months after the required time for stamping. The exchange operator said MoF recently announced that the stamp duty is set at RM150 for every RM1000 or fractional part of RM1000 of the value of the contract note of any shares or stock and. Stamp duty for instrument of transfer Stamp duty on loan agreement Total stamp duty to be paid First RM100000 x 1 Next RM400000 x 2 05 of loan amount assuming 90 of property price RM450000 RM1000 RM8000 05 x RM450000 RM9000 RM2250 RM11250.

April 12 2021 By webmaster. A Non-government contract ie. Instruments exported to Malaysia and subject to customs duties must be stamped within 30 days of the execution date.

Following the above the Stamp Duty Remission Order 2021 PU. Stamp duty of a lease agreement The stamp duty rate is prescribed under the Stamp Act 1949. Pursuant to section 47 of the stamp act 1949 any unstamped instrument drawn or made within malaysia may be stamped after execution on payment of the unpaid duty if the instrument is presented for stamping within thirty 30 daysof its execution if executed within malaysia or within thirty days after it has been first received in malaysia if it.

In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. The stamp duty is free if the annual rental is below RM2400. 7 Order 2020 PUA 379 was gazetted on 28 December 2020 to provide a stamp duty exemption on the financing agreements under the TSPKS and IPPKS financing programmes pursuant to the Tawarruq concept executed between an individual and Bank Pertanian Malaysia Berhad Agrobank.

You need to pay Stamp duty for SPA and Loan agreements when buying a house. However for the following instruments stamp duty can be paid over 01. Between FederalState Government of Malaysia and service providers.

In general stamp duty is applied to legal commercial and financial instruments. Paragraph 2 1 of the 2010 Order remits the amount of stamp duty chargeable under Item 22 1 b which is in excess of 01 of any sums of money relating to the service agreement described in Paragraph 2 2 of the 2010 Order that is. There are two types of Stamp Duty namely ad valorem duty and fixed duty.

For the ad valorem duty the amount payable will. Exemption from stamp duty on the deed of transfer and loan agreement for the purchase of a dwelling worth RM300001 to RM2500000 by Malaysian citizens under the Home Ownership Campaign 20202021. The Order provides that instruments of service agreements Note that are chargeable under Item 22 1 a First Schedule of the SA will be subject to stamp duty at a rate of 0.

Below is the stamping fee calculation. The stamping is done by the Inland Revenue Board of Malaysia in order to make the Tenancy Agreement lawful and admissible in court and it is required by law LHDN. Stamp duty only applies to sales contracts concluded from 1 July 2019 to 31 December 2020 by a legitimate Malaysian citizen.

When the instruments are executed outside Malaysia they must be stamped within 30 days after they have first been received in Malaysia. Stamping Instruments executed in Malaysia which are chargeable with duty must be stamped within 30 days from the date of execution. In Malaysia stamp duty is a tax levied on a large number of written instruments defined in the First Schedule of Stamp Duty Act 1949.

Ringgit Malaysia loan contracts are generally taxed with a stamp duty of 05. If an unstamped agreement was to still be admitted to the court as evidence by the parties a penalty would be imposed due to such delay in stamping pursuant to section 47a since an agreement or instrument must be stamped within 30 days of its execution signing if executed within malaysia and the court will make a consequential order for the. Between private entity and service providers.

The Stamp Duty Exemption No. What does it mean to stamp a document. It has to be based on the amount of monthly rental and the lease period- RM4 for every RM250 of the annual rental above RM2400.

With regard to the Memorandum of Transfer the rates of the duty are as follows For every RM100 or fractional part of RM100 of the contract price or the market value of the property whichever shall be greater i RM1 on the first RM10000000. The buyer usually receives three 3 to four 4 weeks to pay stamp duty otherwise a fine would be imposed. Stamp duty on foreign currency loan agreements is usually limited to RM2000.

It may take about a week for the stamp board to return the duly confirmed form to. B Government contract ie. However the Act does not state clearly whether or not.

There are 4 tiers of Stamp duty rates. The administrative fee is paid to the real estate agent or to the landlord who owns the property. A 428 was gazetted on 25 November 2021 and is deemed to have come into operation on 28 December 2018.

And this order came into effect on 1 Jan 2015 and are. The higher the house price the more expensive the stamp duty. 6 Lawyer collects the buyers stamp duty and goes on the form of stamp transfer.

The exemption will apply to. Stamp Duty Remission Order 2014 provides for the remission of 50 from the stamp duty chargeable on any loan agreement to finance the purchase of only one unit of residential property costing not more than RM500000 subject to the stipulated conditions. Stamp duty on foreign currency loan agreements is generally capped at RM2000.

The stamp duty chargeable on the Sale and Purchase Agreement is RM10 each. In general term stamp duty will be imposed to legal commercial and financial instruments. The Loan Agreement stamp duty is only 050 of the total loan amount.

Stamp duty of 05 on the value of servicesloans. First level Subsequent levels First level Second level. You can get a Stamp Duty Exemption if you are a first-time house buyer.

Stamping A Contract Is An Unstamped Contract Valid

If A Tenant Damages Your Property In Malaysia Asklegal My

Proposed Ad Valorem Stamp Duty To Be Paid When Contract Signed Publication By Hhq Law Firm In Kl Malaysia

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

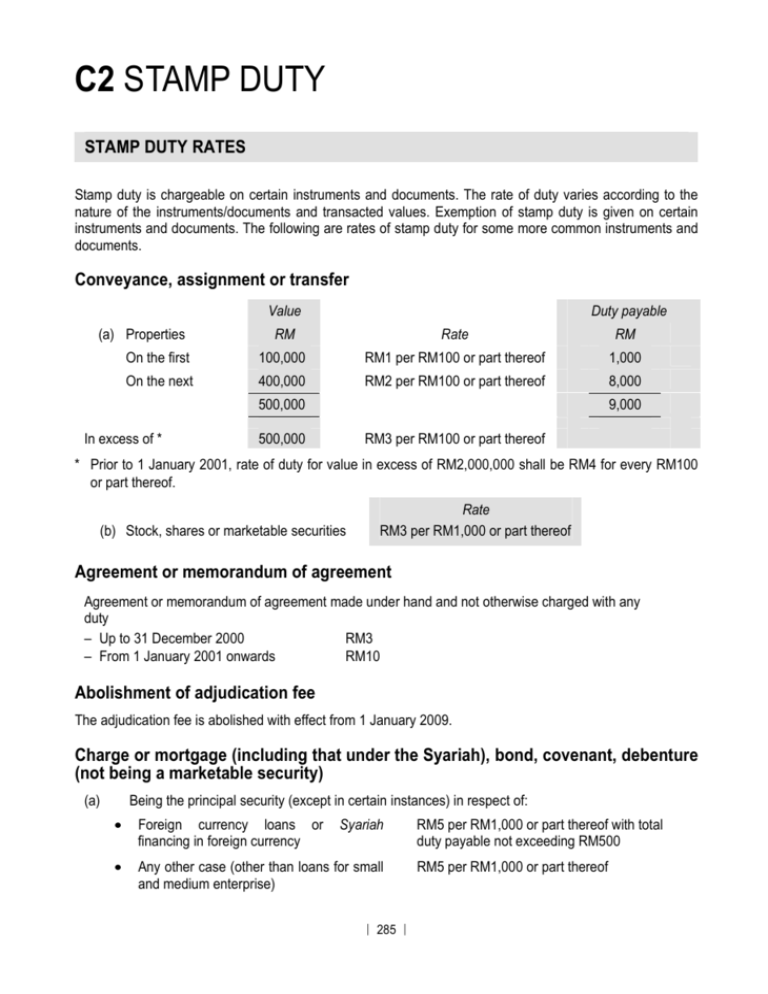

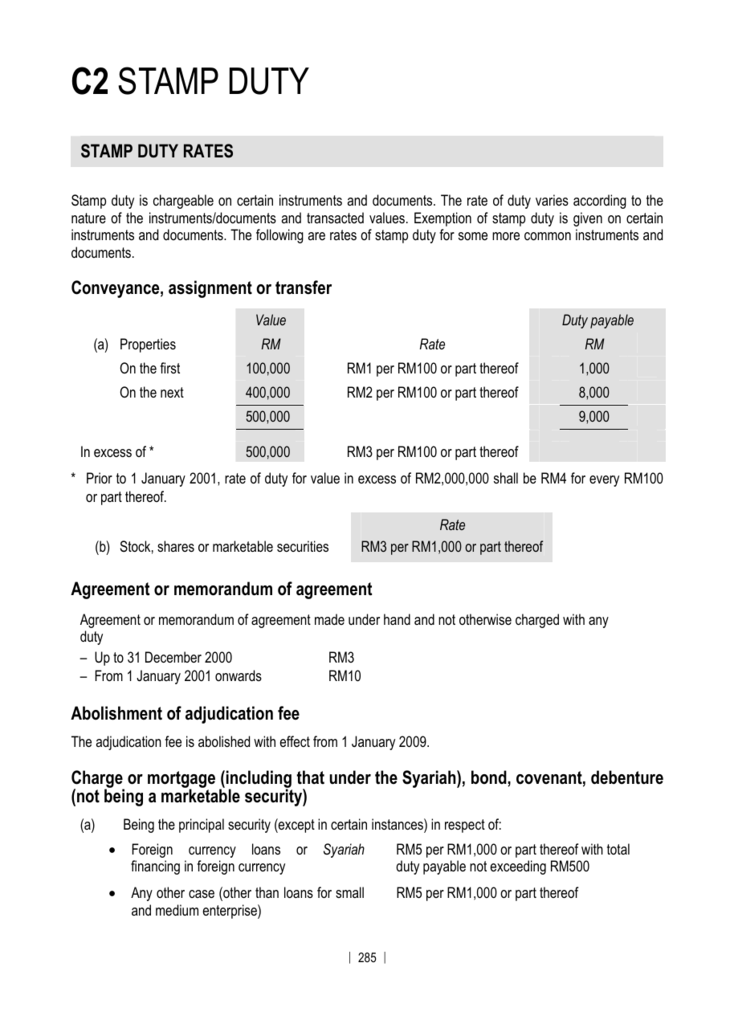

C2 Stamp Duty The Malaysian Institute Of Certified Public

C2 Stamp Duty The Malaysian Institute Of Certified Public

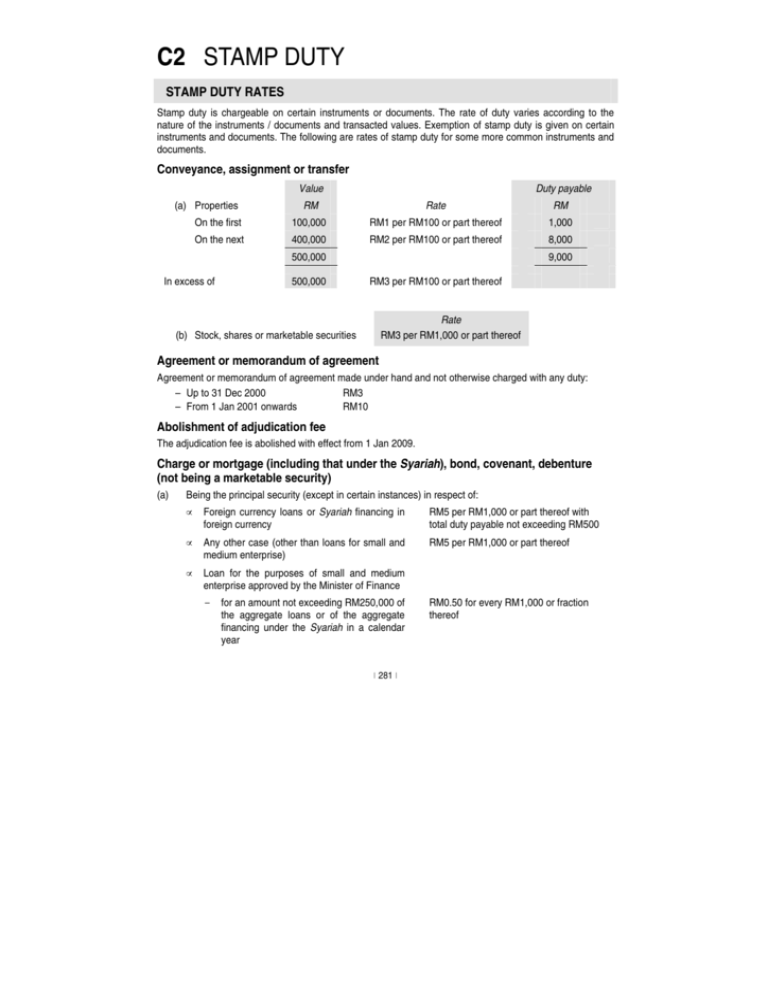

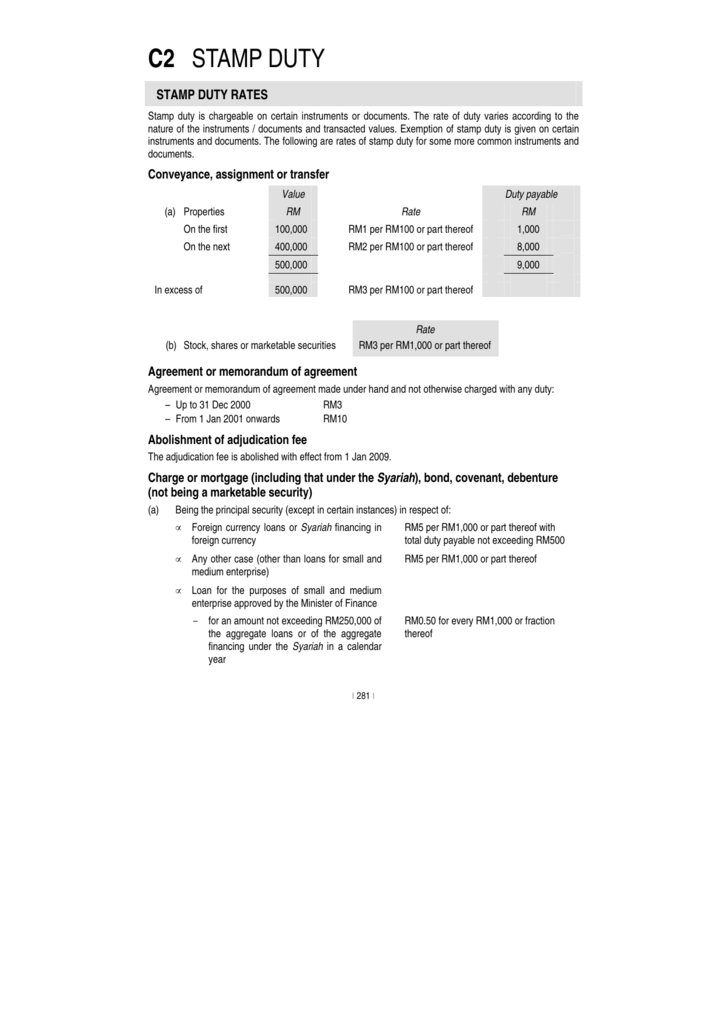

C2 Stamp Duty Malaysian Institute Of Accountants

Stamp Duty Calculation In Malaysia For Contract Gordoncxt

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate Malaysia

C2 Stamp Duty Malaysian Institute Of Accountants

Ws Genesis E Stamping Services

2020 Stamp Duty Exemptions News Articles By Hhq Law Firm In Kl Malaysia

What To Remember About Stamp Duty In Malaysia

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

Drafting And Stamping Tenancy Agreement

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Malaysian Stamp Duty Handbook 6th Edition Marsden Professional Law Book

Tenancy Agreement In Malaysia The Ultimate Guide Speedhome Guide